We grow a little poorer by the day

The inflation risk, ever tenser relations with the USA and Europe, the Zarrab trail and the government’s statements targeting the Central Bank have continued to rattle the markets. With the dollar making a historic high yesterday, the euro also continued to rise. The Turkish lira was the developing-market currency to suffer the greatest depreciation.

The inflation risk, ever tenser relations with the USA and Europe, the Zarrab trail and the government’s statements targeting the Central Bank have continued to rattle the markets. With the dollar making a historic high yesterday, the euro also continued to rise. The Turkish lira was the developing-market currency to suffer the greatest depreciation.

Following the sharp rise in foreign exchange rates, there was an intervention by the Central Bank of the Republic of Turkey (CBRT). Following this intervention, the dollar fell back to 3.95, the euro to 4.64 and the pound sterling to 5.24, but this was insufficient to prevent the Turkish lira from being the developing-market currency to suffer the greatest depreciation.

CBRT’s disguised interest-rate hike

The CBRT yesterday made a move that has been interpreted as being a “disguised interest-rate hike” and undertaken a 25 basis-point tightening of its liquidity policy. The CBRT will as of today provide daily funding for banks entirely from the late liquidity window. This move will see the average funding cost rising from 11.99% to 12.25%.

Dollar forecast: 4.20

Bankers, noting that the CBRT has intervened four times in the market in the past few weeks, are concerned as to whether the interventions may not have been late in view of the rise in inflation. Mizuho Bank’s Deputy CEO Shigehisa Shiroki said that the year-end dollar/TRY level of 4.20 had long been targeted.

Finansbank Chief Economist Gökçe Çelik said, “The likelihood of the Turkish lira continuing to depreciate may force the CBRT to make a meaningful interest-rate hike; this will correspond to a real interest rate of at least 3.5-4%.”

Özlale: It will come at a high cost

Prof. Dr. Ümit Özlale, former consultant at the CBRT Economic Research and Monetary Policy General Directorate and faculty member at Özyeğin University, assessed the rise in the exchange rate and the CBRT’s decisions for Cumhuriyet: “There are many fundamental problems such as deteriorated inflation dynamics, the increasing country risk premium and private sector borrowing trapped in the short term. There is not much merit in investors’ eyes to ignoring all of this and getting side-tracked. My fear is that the attempt to disguise these problems with day-to-day measures will come at a high cost in the coming period.”

|

Subran: We must depressurise the pressure cooker

Ludovic Subran, Global Head of Macroeconomic Research at Allianz and Euler Hermes Group Chief Economist, said, “Turkey is like an overheated pressure cooker: The pressure caused by depreciation of the Turkish lira and inflation is imposing a burden on both households and companies. 2018 is a wonderful year for depressurising the pressure cooker: it is absolutely the correct time to soften the loan market and financial risks, to make it easier for companies to invest and export and to export more to a growing European market.”

Subran, who spoke at this year’s Allianz Turkey, Euler Hermes Turkey and Allianz Worldwide Partners Turkey International Trade Observatory, said that Turkey had exhibited a surprising economic performance in 2017. Subran stated that he expected growth at the level of 3.5% accompanied by inflation at 9% for 2018. Subran further forecast a 10% depreciation of the Turkish lira against the euro-dollar currency basket for 2018.

Euler Hermes Supervisory Board Member Ümit Boyner spoke of an immediate need for a move away from education towards the needs of manufacturing and Industry 4.0, in short for a “structural reform” agenda.

Carsten Hesse: Investors want to see an interest rate hike

According to foreign analysts, investors are expecting the Central Bank to act in a more concrete manner in the face of the fall in the lira. EME equity strategist at Berenberg, Carsten Hesse, appearing on a Bloomberg HT live broadcast, said, “Investors want to see more clearly that the CBRT is independent and will follow a more hawkish monetary policy and raise interest rates.” Hesse said that all kinds of interference on the part of politicians was having a negative effect and pushing the dollar up even more against the TRY. The strategist said, “In Turkey, both the interest rate and inflation are at 12%, that is, the real yield is equivalent to zero and this remains too low to invest. For as long as no clear message comes from the CBRT, the TRY will continue to depreciate.” |

Turkey’s risk premium at a seven-month peak

The Turkish lira’s record fall against the dollar and depreciation against similar currencies has come in parallel with a rise in the risk premium. Turkey’s five-year credit default swap (CDS) rose to its highest level since April 2017 at 216.9.

Countries with a high CDS premium, and entities within the country, must bear higher costs to meet their borrowing requirements. Hence, the CDS premium constitutes an important indicator for countries.

En Çok Okunan Haberler

-

CHP'ye yeni transferler: Rozeti Özel takacak

CHP'ye yeni transferler: Rozeti Özel takacak

-

Tartışmalar sonrası istifa etti! Yeni CEO eşi oldu

Tartışmalar sonrası istifa etti! Yeni CEO eşi oldu

-

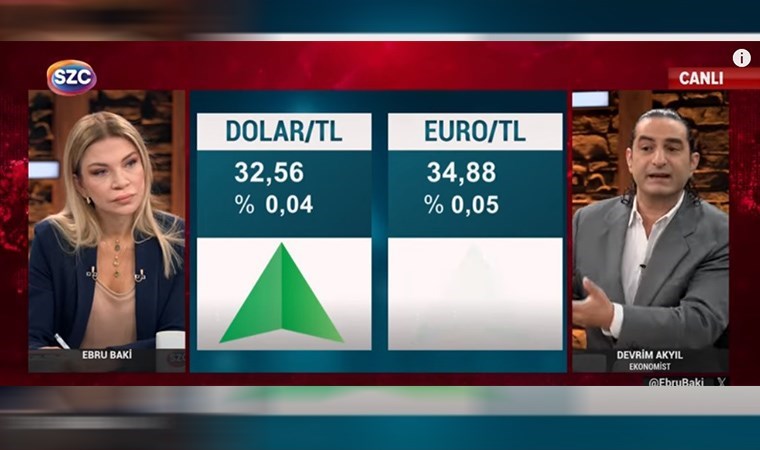

Canlı yayında 'dolar' tartışması: Tansiyon yükseldi

Canlı yayında 'dolar' tartışması: Tansiyon yükseldi

-

Yandaş ‘gazeteci’den tepki çeken çıkış

Yandaş ‘gazeteci’den tepki çeken çıkış

-

Mevduat hesaplarında yeni dönem

Mevduat hesaplarında yeni dönem

-

'Müzakere edilmez!'

'Müzakere edilmez!'

-

Erdoğan ve Steinmeier'ın diyaloğu gündem oldu

Erdoğan ve Steinmeier'ın diyaloğu gündem oldu

-

'Şu an Cumhur İttifakı'nda mısınız' sorusuna yanıt

'Şu an Cumhur İttifakı'nda mısınız' sorusuna yanıt

-

Mersin’de hasat erken başladı: Kilosu 45 TL

Mersin’de hasat erken başladı: Kilosu 45 TL

-

Mehmet Ali Yılmaz evinde ölü bulundu!

Mehmet Ali Yılmaz evinde ölü bulundu!