Oil prices climb as markets focus on supply tightness

Oil prices rose by more than $1 a barrel on Wednesday as markets focused on supply tightness heading into winter and a "soft landing" for the U.S. economy.

Brent crude futures were up 74 cents, or 0.8%, to $94.70 a barrel by 0645 GMT, after rising as much as $1.03. U.S. West Texas Intermediate crude futures climbed 83 cents, or 0.9%, to $91.22 after gaining as much as $1.11.

Industry data released on Tuesday showed U.S. crude oil stockpiles rose last week by about 1.6 million barrels, against analysts' expectations for a drop of about 300,000 barrels.

However, markets continued to worry about U.S. crude stockpiles at the key Cushing, Oklahoma, storage hub falling below minimum operating levels.

Further drawdowns at Cushing, the delivery point for U.S. crude futures, could also provide new upward pressure on oil markets as it would compound supply tightness stemming from supply cuts by the Organization of the Petroleum Exporting Countries and allies, together called OPEC+.

"Oil prices are overall relatively strong amid the current tightening of supply," said CMC Markets analyst Leon Li, however adding that price support from Russia and Saudi Arabia supply cuts may be limited through the year-end.

"(Economic) data from countries in Europe and the United States have recently weakened ... Oil prices in October may show a volatile trend as a whole. It is unlikely to exceed $100 in the short term, but it is expected to be strong."

U.S. government data on oil inventories is expected at 10:30 a.m. (1430 GMT).

While some analysts expect refineries' seasonal autumn maintenance will help build crude stocks a bit, others worry that high export demand could draw barrels away.

Additionally, analysts at ANZ Research said in a Wednesday note that Russia's recent export ban on gasoline and diesel "means upward pressure on crude oil demand from refineries."

Russia last week imposed a temporary ban on gasoline and diesel exports to all countries outside a circle of four ex-Soviet states with immediate effect in order to stabilise the domestic market, but later softened restrictions.

Exports of products already accepted by Russian Railways and Transneft can go ahead, while higher-sulphur gasoil and fuel used for bunkering will be exempt from the ban.

Meanwhile, a "soft landing" for the U.S. economy is more likely than not, Minneapolis Federal Reserve Bank President Neel Kashkari said on Tuesday, but there is also a 40% chance that the Fed will need to raise interest rates "meaningfully" to beat inflation.

Kashkari pegged the probability at about 60% that the Fed "potentially" raises rates one more quarter of a percentage point and then holds borrowing costs steady "long enough to bring inflation back to target in a reasonable period of time."

The Bank of England has concluded its tightening cycle and will likely keep the Bank Rate at 5.25% until at least July, a Reuters poll of economists showed, although a significant minority said it would hike rates again this year.

Higher interest rates increase borrowing costs, which could slow economic growth and reduce oil demand.

En Çok Okunan Haberler

-

Korhan Berzeg olayında yeni gelişme

Korhan Berzeg olayında yeni gelişme

-

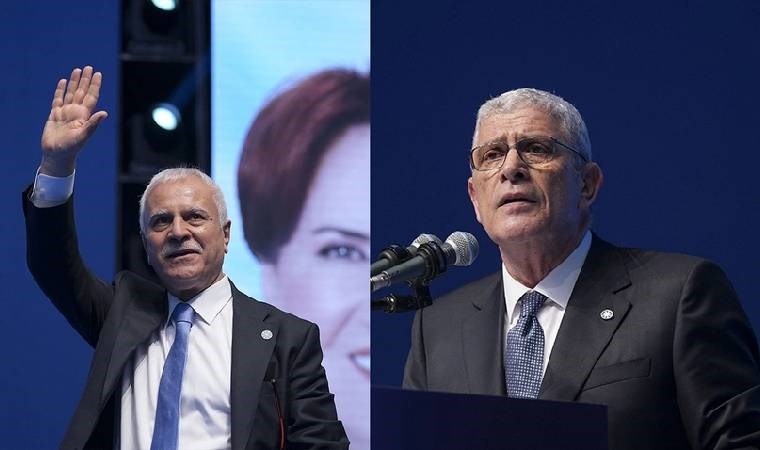

Akşener'den kurultayda 'veda' konuşması

Akşener'den kurultayda 'veda' konuşması

-

Polis meslektaşlarına ateş etti

Polis meslektaşlarına ateş etti

-

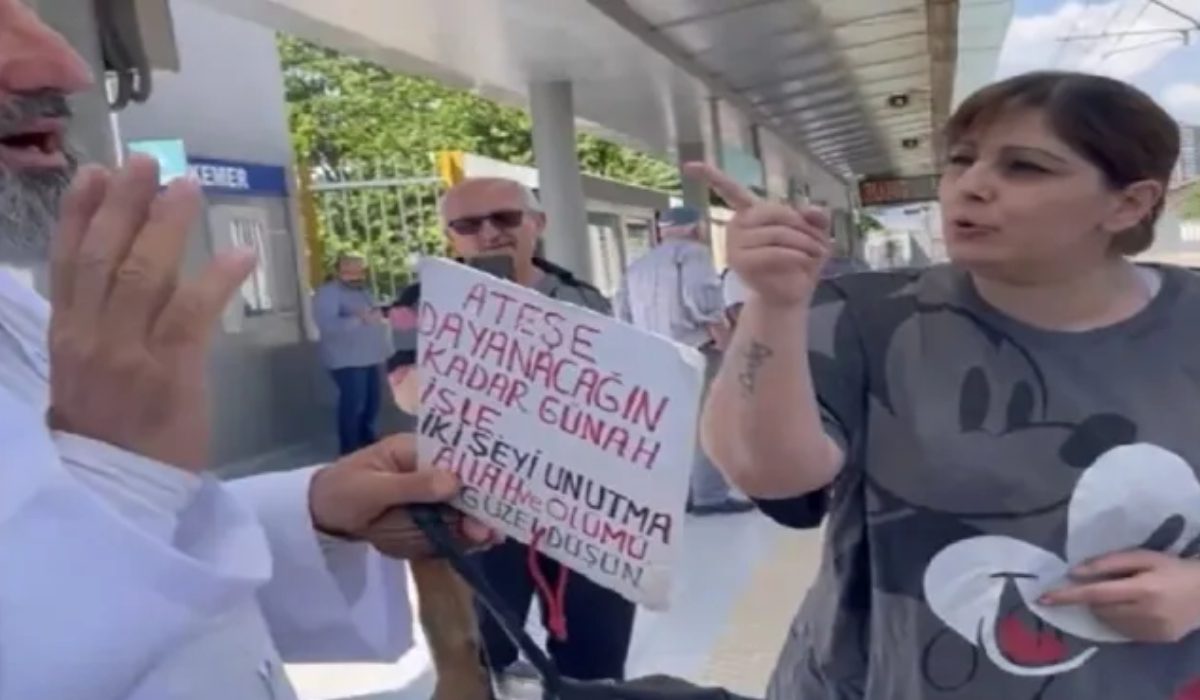

Kadınlara 'Cehennemde yanacaksınız' diye bağırdı

Kadınlara 'Cehennemde yanacaksınız' diye bağırdı

-

Müsavat Dervişoğlu İYİ Parti Genel Başkanı oldu

Müsavat Dervişoğlu İYİ Parti Genel Başkanı oldu

-

Mert Hakan Yandaş'dan sosyal medyada çok sert tepki!

Mert Hakan Yandaş'dan sosyal medyada çok sert tepki!

-

'Türkiye ilk etkilenenlerden olacak...’

'Türkiye ilk etkilenenlerden olacak...’

-

İYİ Parti'de tarihi kurultay: Seçim üçüncü tura kaldı!

İYİ Parti'de tarihi kurultay: Seçim üçüncü tura kaldı!

-

Rakı fiyatlarına büyük zam

Rakı fiyatlarına büyük zam

-

CHP lideri Özel'den ilk açıklama!

CHP lideri Özel'den ilk açıklama!