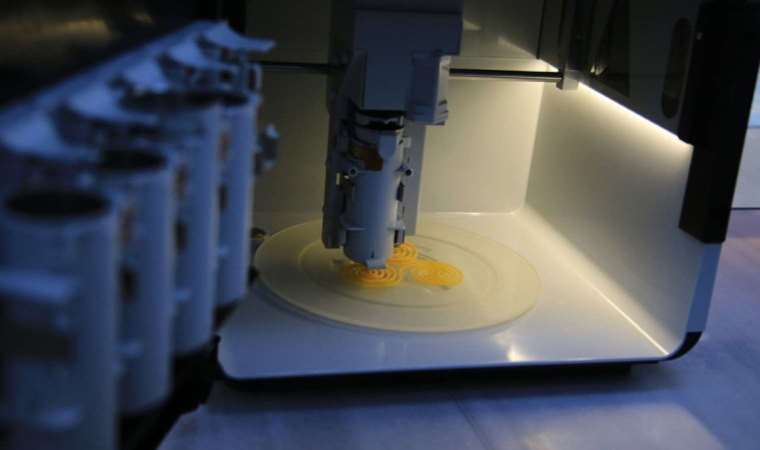

3D-printing takeover battle misses third dimension

The 3D printing industry is engaged in a messy game of four-dimensional takeover chess.

The 3D printing industry is engaged in a messy game of four-dimensional takeover chess. Stratasys (SSYS.O) for now prefers a merger with peer Desktop Metal (DM.N), but a sweetened bid from Nano Dimension (2N5By.F) complicates matters. A simpler two-dimensional financial analysis suggests a snubbed offer from 3D Systems (DDD.N) may wind up the best option.

A decade ago, falling prices for the compact technology able to cheaply construct car parts, eyeglass frames and other objects from digital files created Wall Street buzz. The manufacturing hype outpaced any ability to generate profit, however. Cost-cutting and consolidation are now the focus.

Nano kicked things off in early March by offering to buy the roughly 86% of Stratasys it didn’t already own for $18 a share, or $1.1 billion, a 36% premium to where the stock had been trading. Two months later, Stratasys unveiled a $1.8 billion all-stock union with Desktop Metal. 3D Systems followed with a cash-and-stock proposal. Nano’s latest offer is a third higher, but only to boost its stake to 51%.

According to Reuters columnist Robert Cyran, the Nano deal looks flaky. The company has been embroiled in its own fight against dissidents. Its $770 million market value also is lower than its nearly $1 billion of net cash, which suggests its Stratasys entreaty isn’t impressing investors. Desktop Metal makes a more promising Stratasys partner, partly because it caters to factory floors. There are also some $50 million a year of anticipated cost savings from the transaction and another $50 million in revenue uplift. Even so, Desktop Metal has disappointed before. Its 2023 sales forecast is much lower than it was when it went public through a shell company a few years ago.

Stratasys shareholders currently have a choice between two slates of directors at next month’s annual meeting. The company’s nominees favor the Desktop Metal deal, while Nano’s back the alternative transaction.

Being largely overlooked is 3D’s plan, whose Stratasys offer is now worth about $21 a share, but is for the whole company. In addition, 3D boss Jeff Graves promises $100 million of synergies entirely derived from slashing expenses, which are far easier to deliver than ones reliant on boosting sales. Taxed and capitalized, they’re worth around $800 million, meaning 3D Systems could go as high as $25 a share without destroying value, according to Breakingviews calculations.

3D’s cost cutting would be welcome; all the companies involved are unprofitable. In this multi-dimensional M&A battle, it would be useful to simplify the model and focus on the combination that can deliver the most.

CONTEXT NEWS

Nano Dimension said on June 10 that it had increased its tender offer to buy up to 51% of rival 3D printing company Stratasys to $24 a share, adding that it supports exploring industry consolidation, including a potential combination with 3D Systems.

Stratasys said on July 4 that its shareholders would have their choice of two competing slates of directors at its annual meeting on Aug. 8. It has nominated eight existing members of the board while Nano Dimension, which owns about 14% of Stratasys and initially offered to buy Stratasys in early March, put forward a slate of seven directors.

On May 25, Stratasys agreed to combine with Desktop Metal in an all-stock deal valued at $1.8 billion. Desktop Metal’s shareholders would receive 0.123 shares of Stratasys and own about 40% of the combined company.

On the same day, 3D Systems offered to buy Stratasys for $7.50 a share in cash and 1.3223 3D Systems shares for each Stratasys share. The value of that offer at the close of trading on July 5 was $20.05 per Stratasys share.

Stratasys, whose shares closed at $17.37 on July 7, rejected Nano’s earlier offer and said 3D Systems’ unsolicited bid undervalues the company and does not constitute a superior offer to the Desktop Metal deal.

En Çok Okunan Haberler

-

Mükemmel koca olan 4 burç

Mükemmel koca olan 4 burç

-

Kadınları 'çarşaf'a çağırdılar

Kadınları 'çarşaf'a çağırdılar

-

Metin Külünk'ten, Şimşek'e 'fotoğraflı' uyarı

Metin Külünk'ten, Şimşek'e 'fotoğraflı' uyarı

-

Taksim bombacısı için karar çıktı

Taksim bombacısı için karar çıktı

-

Nihal Candan için yeni karar

Nihal Candan için yeni karar

-

Erdoğan'ın ABD ziyareti ertelendi!

Erdoğan'ın ABD ziyareti ertelendi!

-

Savunma sanayi firmalarının ürünleri, Din dersinde!

Savunma sanayi firmalarının ürünleri, Din dersinde!

-

Hazine ve Maliye Bakanlığı’ndan KDV zammı

Hazine ve Maliye Bakanlığı’ndan KDV zammı

-

İşte 'yeni müfredat' taslağı...

İşte 'yeni müfredat' taslağı...

-

Arda Güler ilk 11 çıktı ve golünü attı!

Arda Güler ilk 11 çıktı ve golünü attı!